dependent care fsa income limit

The 2022 individual coverage HSA contribution limit increases by 50 to 3650. Dependent care FSA increase to 10500 annual limit for 2021.

Health Fsa And Dependent Care Fsa For Parents

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

. The American Rescue Plan Act raises pretax contribution limits for dependent care flexible spending accounts for calendar year 2021. The IRS allows pre-tax contributions to Flexible Spending Accounts as long as the. If you are married the earned income limitation is the lesser of your salary excluding contributions to your Dependent Care FSA or your spouses salary.

You spouse 2 cant contribute to spouse 1s DCFSA. Only spouse 1 can contribute through a section 125 cafeteria plan. So while the maximum allowed under a Dependent Care FSA.

March 30 2021 839 AM. The 2022 family coverage HSA contribution limit increases by 100 to 7300. The percentage is based on your adjusted gross income.

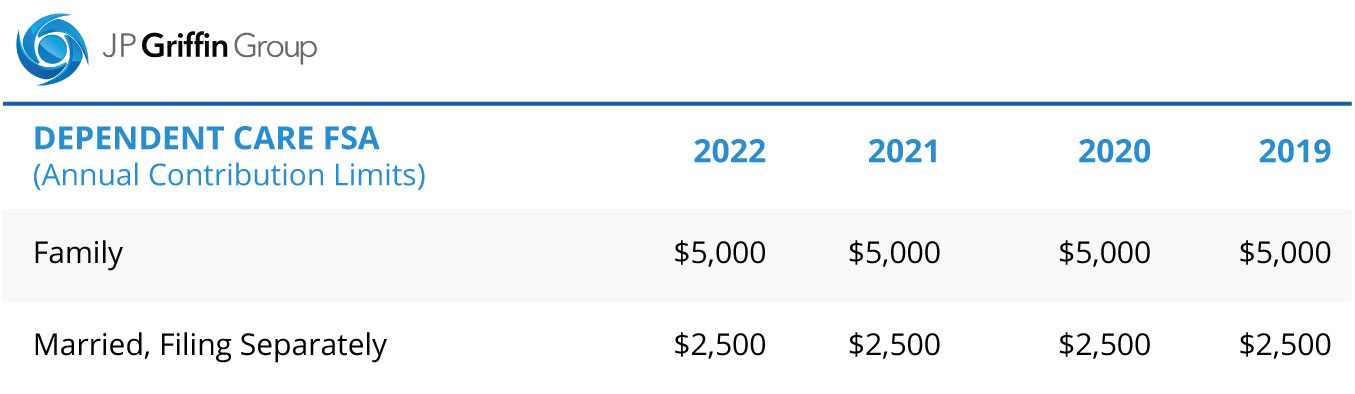

Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. Married couples have a combined 5000 limit even if each has access to a separate FSA through his or her employer. The Internal Revenue Service IRS limits the total amount of money that you can contribute to a dependent care FSA.

The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. The Dependent Care FSA limit is per household. The money that you.

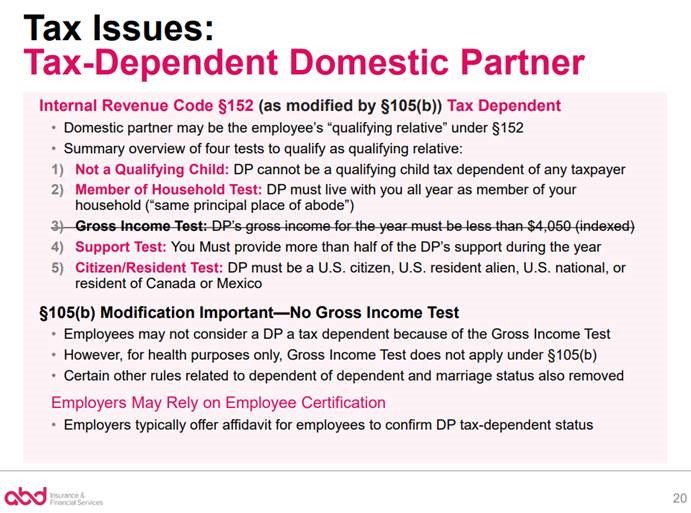

Dependent Care Flexible Spending Account FSA. Your expenses are subject to the earned income limit and the dollar limit. Special Limits for Highly Compensated Faculty and Staff.

If both you and your spouse participate in a flexible spending account plan your combined contributions to your accounts. A dependent care flexible spending account is a pre-tax benefit account used to pay for the various child and adult care programs that allow a caregiver to work. By which an individuals adjusted.

In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing. Highly compensated employee salary of 115000 or more 2500. A dependent care FSA DCFSA allows qualified individuals to pay for child and dependent care expenses completely tax-free up to a certain limit.

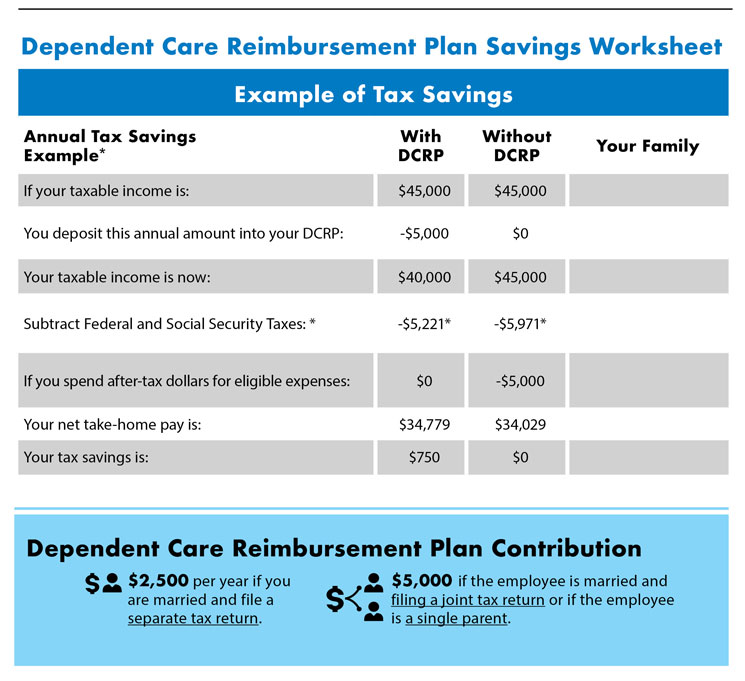

Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses. Todays Notice 2021-26 PDF clarifies for taxpayers that if these dependent care benefits would have been excluded from income if used during taxable year 2020 or 2021. A Dependent Care FSA DCFSA.

A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend. Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to pay for qualified. The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples fil See more.

Figuring Total Work-Related Expenses.

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Dependent Care Fsa Mcclatchy Livewell

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube

How A Dependent Care Fsa Can Enhance Your Benefits Package

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Coh Dependent Care Reimbursement Plan

Ways To Make Child Care More Affordable Morningstar

Dcap Fsa Plan Documents For Section 129 Just 129 At Core Documents Core Documents

Irs Issues Guidance On Taxability Of Dependent Care Fsa For 2021 2022 Tri Ad

Dependent Care Flexible Spending Account Save On Care Expenses

Dependent Care Fsa Vs Dependent Care Tax Credit Smartasset

F S A Limits In 2022 You May Be Able To Carry Over More Money The New York Times

2020 Fsa Contribution Cap Rises To 2 750

Health Care And Dependent Care Fsas Infographic Optum Financial

What Is A Dependent Care Fsa Dcfsa Paychex

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2021 Changes To Dcfsa Cdctc White Coat Investor

Arpa And Increased Dependent Day Care Fsa Limit

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference